The Mystery of Bankruptcy between Schools and Enterprises in Northern Qing Dynasty

Author/Pot Meat under the Starry Sky

Editor/spinach starry sky

Typesetting/small fish under the stars

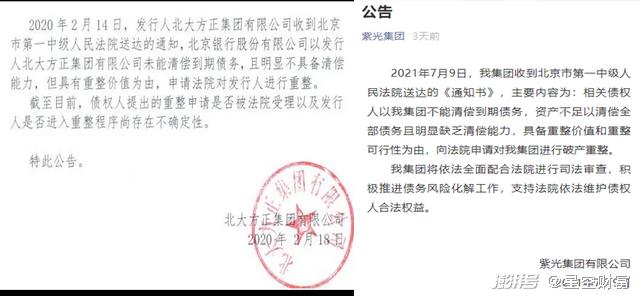

In February last year, Peking University was applied for bankruptcy and reorganization by the bank because it owed money. In July this year, thunis also took the founder’s old road.

Let me explain first, both Founder of Peking University and thunis are bankruptcy reorganization, not bankruptcy liquidation. Literally, it looks the same, but the difference is not small. Liquidation is equivalent to the company’s hopeless. Let’s see how many assets are sold. If the creditors get a share, the company will be gone. Reorganization means that the company still has the value of survival, so find some investors or adjust the debt to help the company tide over the crisis.

For example, Peking University Founder, which entered bankruptcy and reorganization earlier, submitted a reorganization plan to the court on April 30th this year. China Ping An and Zhuhai Huafa (with Zhuhai State-owned assets behind them) became shareholders of Founder Group, and Founder was consolidated by Ping An.

Therefore, after the reorganization, the shareholding structure is affected, and the company is still operating. Those who say that Founder and Ziguang closed down are not strictly correct.

Although the reorganization is not so serious, the real problem exposed by bankruptcy reorganization is bankruptcy.

Founder of Peking University and thunis, one of the best school-run groups in China, have hatched a number of listed companies. Backed by Peking University and Tsinghua, there is no shortage of financial support and talents, and there is no need to pay too high salary. It can be said that he was born with a golden spoon in his mouth, so why did he go bankrupt?

1. M&A expansion, debt overload

On the surface, both Founder of Peking University and thunis are seriously overloaded with debts due to crazy expansion.

Peking university Fangzheng

Founder Group was founded by Peking University in 1986. Relying on the "Chinese character information processing and laser phototypesetting technology" invented by Academician Wang Xuan of Peking University, Founder Group almost monopolized the Chinese character newspaper market in just a few years.

However, with the market becoming more and more saturated, Founder’s growth rate slowed down, and by 1998, losses had already occurred. After that, Wei Xin, who taught at Peking University, was appointed to the Founder. The core of Wei Xin’s strategy is diversification, and the means of diversification is buying. So Wei Xin invited a giant Buddha-Li You who knows the capital game well. Please remember this person, which will be mentioned later.

After Li You joined, Founder Group gradually became a financial holding group from a purely technical enterprise. IT, finance, real estate, medical care and education are all involved. Founder Group’s current business map was formed at this time.

But the pace of mergers and acquisitions is too big, so you can only borrow if you have no money. In 2013, Founder Group’s asset-liability ratio has reached 65%, with liabilities of 62 billion. You know, at that time, the total income of the whole year was only 68 billion yuan, and it was impossible to repay the debt by profit.

The next development and expansion of Founder Group can only be based on constantly borrowing the new and returning the old. The assets are getting bigger and bigger, and the debts are getting more and more. By 2018, Founder Group will have total assets of 360.6 billion and liabilities of 295 billion. The asset-liability ratio has exceeded 80%. Once you can’t borrow money, the capital chain will inevitably break.

UNIS

Unlike Founder Group, Ziguang is still a technology group focusing on chips and clouds. But this technology giant can have the present size, and it is also the way to buy from buy buy.

In 2009, a new management took office. Zhao Weiguo, the chairman of the board of directors, thinks that our country’s technology is backward in making chips, so we should buy all the foreign ones back. After that, with the upsurge of chip development, it began to buy in 2013, covering chip design, chip manufacturing, chip packaging, memory chips and other sub-fields.

In less than ten years, Ziguang has engaged in dozens of mergers and acquisitions. In 2012, the group’s total assets were less than 7 billion, and in 2020, it was close to 300 billion. However, its liabilities have reached 200 billion.

Although Ziguang has been expanding in the field of chips around its main business, the characteristics of technology research and development are high investment and long-term return. At present, the profitability of the company acquired by Ziguang can’t even cover the debt interest, which eventually leads to high debts and unbearable burdens.

2. State-owned enterprise holding, prestigious school aura

Beneath the surface, there are two problems.

First, why can Founder and Ziguang borrow hundreds of billions of foreign debts?

Second, do Founder and Ziguang have no sense of debt crisis at all?

The first question is easy to answer. It is easy for state-owned enterprises, prestigious schools, Founder and Ziguang to borrow money. Just before Founder’s first debt defaulted, Founder’s credit rating was still 3A with a debt ratio of 70%+. So, as long as Founder can hold on, and don’t put such a thing as thunderstorm in the open, he can borrow money. It’s just that it’s getting more and more difficult, and finally the speed of borrowing money can’t keep up with the demand for paying back money.

As for the second question, it is complicated.

1. Non-profit shareholders, leverage to pry profits.

For companies, the smaller the debt, the better. If a company wants to make money, it definitely needs to invest first. This investment comes from two aspects, one is the money invested by shareholders, and the other is the money borrowed from outside.

Who are the shareholders of Ziguang and Founder? Tsinghua Peking University, a non-profit organization. I want to know that the school will definitely not invest too much money to run a business. But I want to make money, what should I do? At this time, the role of adding leverage is reflected.

Add leverage, that is, use small money to incite large funds. For example, shareholders invest in 100 yuan, and with this 100 yuan to refinance 200 yuan, the company can use 300 yuan to operate and make money. It is equivalent to a direct tripling of the scale of assets and profits. Of course, money is not borrowed for nothing, and you have to pay interest, but interest expenses can also save taxes. For Tsinghua Peking University, a shareholder with little money, there is no loss in any calculation.

2. The disadvantages of state-owned enterprises, enterprises and management interests are different.

State-owned enterprises, as the name implies, are state-owned. Therefore, as a leader, you must first make some achievements. Without the expansion of mergers and acquisitions, Founder and Ziguang can only be called enterprises now, not groups. As for the hidden dangers buried, that is the matter of the successor. Of course, the successor can also be said to be a problem left over from history. Hello, I am good and everyone is good.

And the interests are their own. Whether it’s the link of borrowing money or the link of acquisition, the Qian Qian transaction, more or less, carries the money right to trade behind it. Founder’s management once went to prison for insider trading. This story begins with the following restructuring of state-owned enterprises.

3. The restructuring of state-owned enterprises has become a struggle for equity.

Because there are many shortcomings in state-owned enterprises, our country has been promoting the restructuring of state-owned enterprises. Try to introduce high-quality social capital and revitalize state-owned assets.

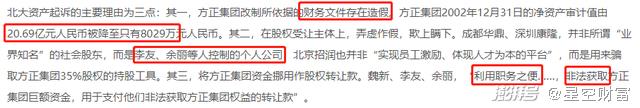

As early as 2003, Founder of Peking University started restructuring. Introduced three companies and acquired 65% equity of Founder. However, these companies are actually controlled by Founder management. The core figure of management is CEO Li You.

This man is known as the rogue in the capital market. Backed by private capital groups, it has got its hands on many listed companies. Later, after entering Founder, the management was basically replaced by Li You’s relatives and classmates. At that time, Wei Xin, the chairman of Li Youjin Founder, was highly recommended, and he also became a group of friends and relatives of Li You. There is also the shadow of Wei Xin among the shareholders of the company introduced through restructuring.

In 2013, Li You quarreled with Zhengquan Holdings, an external ally, and the alleged insider trading of Founder management was uncovered. At the end of 2016, Li You was sentenced to four and a half years in prison and fined 750 million. However, at the beginning of the next year, he was released on bail for suffering from liver cancer.

In 2015, Founder returned to Peking University Assets for management. At this time, Peking University Assets began to investigate the restructuring of that year and found that Li You and others reduced the net assets of 2 billion to 80 million. Moreover, the money these people paid for the transfer price was illegally obtained from Founder, and they were really empty-handed.

Founder of Peking University has been developing in the hands of these people for more than ten years. Until now, Zhaorun Investment controlled by Li You still holds 30% equity of Peking University Founder. Moreover, Zhaorun Investment also sued Peking University Assets in turn, demanding the return of licenses and other information. Li You and others’ road to power has never stopped.

Thunis’s restructuring is later, and it seems that it is not as wonderful as Peking University Founder. Interestingly, however, the actual controller of Jiankun Investment, which holds 49% shares of Ziguang, is Zhao Weiguo, chairman of Ziguang.

State-owned enterprise executives are really rich when they can buy less than half of Ziguang Group.

3. Get rid of the baggage and get on the road easily

Ziguang and Fangzheng, blindly expanding, led to excessive debt. There will always be a thunderstorm debt, which will be the last straw to crush the camel. The reason for this situation is that on the one hand, because of the identity of state-owned enterprises and prestigious schools, financing is convenient; On the other hand, trapped by the ills of state-owned enterprises, the interest transfer is stealth.

However, with the support of funds and talents, Ziguang and Founder still have the value of reorganization even if they have many problems. Ziguang has received many technology companies, and it has indeed improved the overall technical level. There are really few companies in China that can compete with Ziguang.

Maybe bankruptcy is not a bad thing for these two companies. Early detection, early treatment, early recovery and early growth.

If you really lose your baggage, you don’t have to carry it.

Note: This article does not constitute any investment advice. The stock market is risky, so you need to be cautious when entering the market. No business, no harm.