JD.com continues to up the ante community group buying, 800 million Hong Kong dollars to invest in agricultural product distribution service provider

JD.com up the ante community group buying, and there is a new action.

Yesterday evening, the mainland agricultural products wholesale market operator China Dili Group (Hong Kong listed company, stock code: HK.01387, referred to as "China Dili") announced that on December 25, the company and the subscriber JD.com Group wholly-owned subsidiary Nelson Innovation Limited entered into a subscription agreement, JD.com Group will be 798 million Hong Kong dollars to subscribe for China Dili 478 million shares, the subscription price is 1.67 Hong Kong dollars per subscription share, with a discount of about 16.5% to the closing price of 2 Hong Kong dollars per share quoted on the Stock Exchange on the last trading day of China Dili shares. After the transaction is completed, JD.com Group will receive about 5.37% of China Dili’s issued share capital.

Regarding the deal, China Dili said that the company and JD.com Group will jointly build the strongest fresh food supply chain system in China.

According to the data, China Geoji is a major agricultural product distribution service provider in China, mainly engaged in shopping mall operations. Currently, it has 10 large agricultural product wholesale markets in 7 cities including Shouguang, Hangzhou, Shenyang and Harbin. In 2019, the commission income was RMB 10 million yuan, and the rental income was 410 million yuan.

In January 2019, China Dili proposed a transformation and upgrading development strategy, that is, through technology and service empowerment, to build an integrated and digital fresh circulation comprehensive service system, transform into a "modern fresh circulation service and supplier", and become the most trusted food circulation service provider. In October of the same year, China Dili Strategy invested in the fresh retail chain "Dili Fresh", and initially formed a three-point and one-line whole-industry chain circulation layout of fresh food "production-circulation-retail".

For this acquisition, China Dili Group said that China Dili and JD.com Group will jointly build the strongest fresh food supply chain system in China. China Dili has the advantage of offline transactions and agricultural and sideline product origin resources linking the production end and the sales end. JD.com Group has global fresh food marketing channels, C-end customer base and logistics warehouse distribution capabilities, as well as modern technology and digital capabilities. The two sides will strengthen the integration of resources and empower each other in the aspects of fresh circulation, supply, upstream and downstream of the industrial chain, through modern technology and digital technology, build a modern fresh supply chain and circulation service platform, realize the digitalization of the whole industrial chain of fresh circulation, the whole process can be traced, food safety is guaranteed, and solve the long-standing social problems such as farmers’ difficulty in selling agricultural products and low prices, while urban consumers buy expensive and food safety is not guaranteed.

The board believes that the acquisition provides a unique opportunity for the company to expand its shareholder base and raise funds for future development and business expansion. The Subscription will further create a synergy effect between ChinaLand and JD.com’s business, driving ChinaLand’s future development and business growth.

In addition, according to E Company, Zhu Danpeng, a Chinese food industry analyst, said that the organic integration of China’s resources in the B-end and JD.com’s advantages in the C-end and technology will help the construction of agricultural products and fresh food supply systems. "The degree of intelligence, standardization and digitalization of the supply system will be improved. For the C-end, consumers will also be able to enjoy better quality agricultural products and fresh food logistics services. I think this will open a new model of upgrading the distribution structure of agricultural products and fresh food in our country."

In fact, fresh food accounts for a high proportion of community group buying,The supply chain system construction of fresh food e-commerce will be one of the key factors for the sustainable development of community group buying, and the cooperation between the two parties is also regarded by the industry as the latest move of JD.com up the ante community group buying.

According to Ernest & Young’s recently released "E-commerce new retail 2.0: From fresh food e-commerce to community group buying, operational efficiency is the key to winning", community group buying has made small progress as early as 2016, and ushered in a blowout under the promotion of capital in 2018. The bubble receded in 2019, and the industry ushered in a reshuffle and integration. The COVID-19 epidemic in 2020 played a very good catalytic and educational role in the community group buying market. During the epidemic, residents go out to reduce, blocked shopping channels, while information transmission and management to the community as a unit, community group buying model to help people solve the daily life of shopping problems, and quickly replicated to each district, community group buying finally ushered in explosive growth.

Community group buying almost always adopts the model of "booking today + next day delivery/self-pickup", providing community residents with fresh food, daily general merchandise and other goods. The most direct is that the goods purchased by users are cheaper and can be picked up around the community.

Before that, JD.com also frequently took action to layout community group buying,In 2019, the community group buying brand "JD.com District Purchase" was launched, and the joint purchase Mini Program "Jingxi" was launched; on December 6 this year, JD.com announced the acquisition of Meicai’s Meijia Shopping; on the evening of December 11, JD.com officially announced that the investment is prosperous and preferred, and the investment amount is 700 million US dollars.This investment in China’s geographical location is also an important part of the layout (strengthening resource integration in fresh circulation, supply, upstream and downstream of the industrial chain, etc.).

Since the beginning of this year, Meituan, Alibaba, Pinduoduo, JD.com and other giants have entered the market together, and they are not aiming at each other’s existing territory, but at an inconspicuous red ocean market in the past.

According to the data of the National Bureau of Statistics, the output of fresh agricultural products in 2019 is about 1.20 billion tons, and the output value of fresh agricultural products is about 7 trillion. If we consider fresh processing, warehousing and circulation, the entire market transaction volume exceeds 20 trillion, and it is expected that the size of the fresh food market in 2020 is expected to reach 331.07 billion yuan. In the first half of 2020, the user stickiness of fresh food e-commerce reached 25.70%, an increase of 6.2% over last year.

At the same time, the penetration rate of fresh food e-commerce is low. According to Euromonitor statistics, from the perspective of channel share, in 2019, traditional farmers’ channels accounted for 48%, supermarket hypermarkets accounted for 36%, and e-commerce channels accounted for from 1% in 2013 to 6% in 2019.

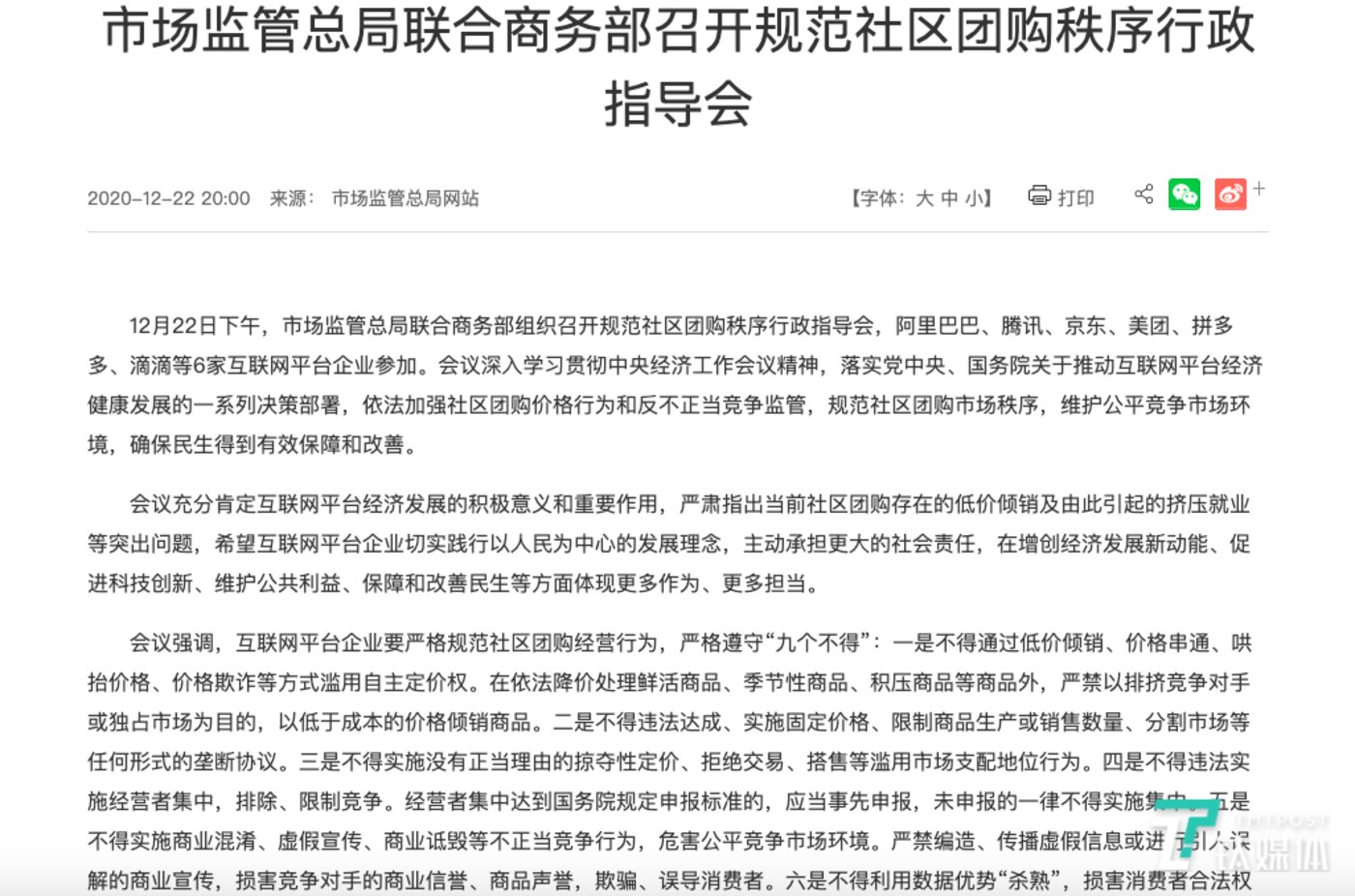

At present, community group buying has also attracted greater skepticism, and the state has now paid great attention to it at the policy level. On December 22, the State Regulation for Market Regulation and the Ministry of Commerce jointly held an administrative guidance meeting on regulating the order of community group buying. Six Internet platform companies from Alibaba, Tencent, JD.com, Meituan, Pinduoduo and Didi participated. The meeting made it clear that Internet platform companies strictly abide by the "nine must not", and the new regulations are of positive significance for the entire community group buying industry to avoid vicious competition and lead the healthy development of the industry.

According to E Company, the development of the fresh food e-commerce industry is also facing some pain points. Zhu Danpeng told that at present, the entire fresh food e-commerce industry has incomplete product structure, different product quality standards, unstable product supply and large losses. The service system of the entire product supply chain also needs to be strengthened.

The Ernest & Young report also pointed out that although fresh food e-commerce has developed rapidly in recent years, it is still very difficult for the industry to achieve profitability. The particularity of fresh products makes the industry also face many difficulties and challenges that are difficult to overcome.

The Ernest & Young report argues that investing a lot of resources and human and material resources can gather traffic in the short term, but the ultimate competitiveness of the community group buying industry still lies in the construction of internal capabilities (supply chain capabilities and cost control are particularly important). Although in the short term, traffic and subsidies can help community group buying platforms to quickly increase volume, community group buying is still essentially a retail business. In the long run, how fast and economical goods are is the key to consumer trust and viscosity, and the ultimate improvement of the operating efficiency of the entire supply chain is the key to the success of the platform. In the national policy environment, in addition to spending resources and energy to occupy market share, community group buying operators need to pay more attention to the cultivation of their own internal capabilities and create a healthy industry ecosystem.

(Ti Media APP editor Wu Fengye from E Company, Ernest & Young)