The founder is sitting on 450 billion yuan of wealth! How does Nongfu Spring "turn water into gold"

Due to the scarcity of high-quality water sources, mineral water is naturally a highly concentrated industry.

The much-watched Hurun Rich List in 2024 was once again won by Zhong Shanyuan, founder of Nongfu Spring, with a total wealth of 450 billion yuan. Zhong Shanyuan became the richest man in China for four consecutive times, and broke the highest record of wealth in China for more than 20 consecutive years. At the same time, the 2024 New Fortune 500 Rich List was also released, and Zhong Shanyuan ranked first with a shareholding market value of 456.27 billion yuan.

Seeing this, I believe everyone can’t help but ask, "How can you make so much money selling mineral water to sell China’s richest man?"

Looking at the list of well-known beverage companies in China, there are already listed giants such as Nongfu Spring, Master Kong, () and (), as well as an unlisted national brand Wahaha; Wahaha’s revenue in 2023 is 51.20 billion yuan, making it the largest water beverage company in China.

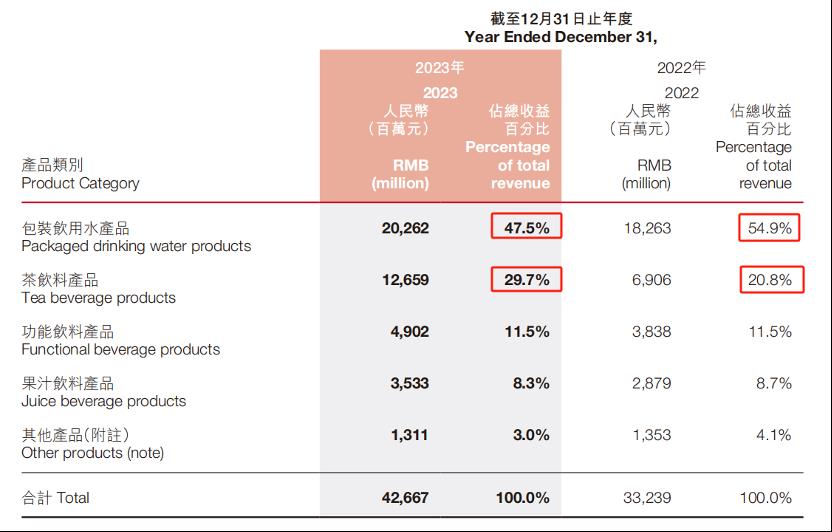

The revenue scale of Nongfu Spring in 2023 is 42.667 billion yuan, which is still less than Wahaha, but it has always been regarded as the most representative benchmark company in the industry. Why is this so? Today we will take a plate of Nongfu Spring. What kind of "killer" can make it stand out and create huge wealth.

Company basic information

Nongfu Spring is one of the "top 20" in China’s beverage industry, and the core brand "Nongfu Spring" is a well-known trademark in China. Since 1997, Nongfu Spring has successively built 12 international leading natural drinking water and fruit juice beverage production bases in Qiandao Lake in Zhejiang Province, Jingyu Mineral Water Reserve in Jilin Province (Jilin Province), Danjiangkou in Hubei Province, the source of the middle route of the South-to-North Water Diversion Project, Wanlv Lake in Guangdong, a national forest park, and Manas in Xinjiang, Tianshan Glacier Region.

(Image source: Nongfu Spring official website)

In 2023, in China’s packaged drinking water market, the top five giants are Nongfu Spring, Yibao, Jingtian, Wahaha, and Master Kong. According to the report of Zhuoshi Consulting, Nongfu Spring’s market share is 23.6%, while Yibao, Jingtian, Wahaha, and Master Kong are 18.4%, 6.1%, 5.6%, and 4.9% respectively. Its market share is evident.

fundamental analysis

Nongfu Spring is really profitable. In 2023, Nongfu Spring’s revenue scale ranked third in the water and beverage market, with 42.667 billion yuan revenue and a year-on-year increase of 28.36%, once again shortening the gap with Wahaha and Master Kong.

By product, the company’s packaged drinking water revenue in 2023 recorded 20.262 billion yuan, an increase of 10.95%, accounting for 47.5% of total revenue.

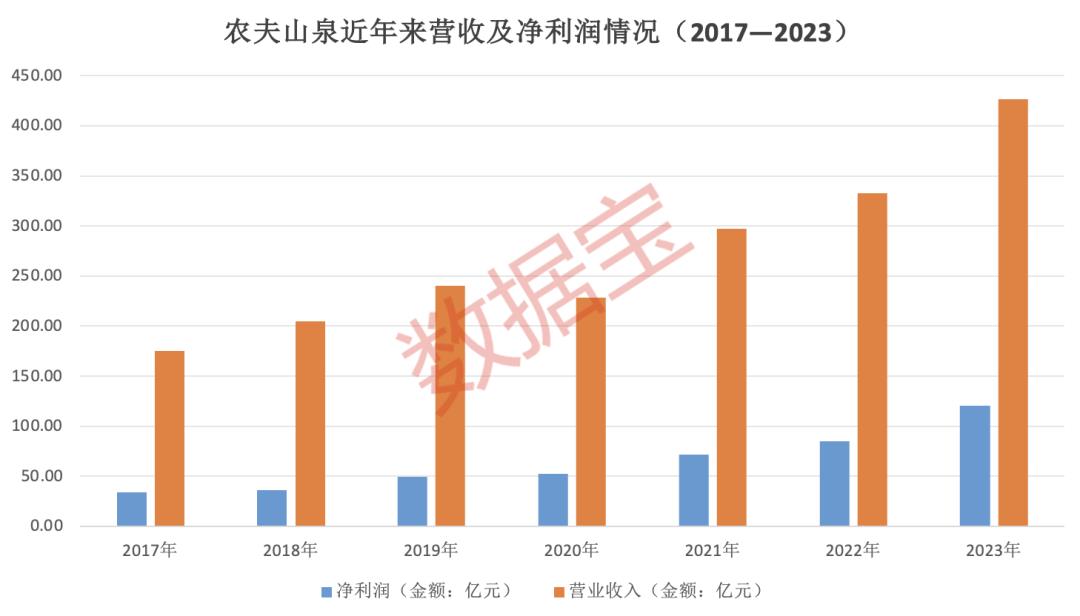

In the past seven years, Nongfu Spring’s revenue and net profit have been increasing year by year, making more money year by year.

From 2017 to 2023, the compounded growth rate of Nongfu Spring’s revenue is nearly 16%, the compounded growth rate of net profit is 27%, and the compounded growth rate of net profit is 11 percentage points higher than that of revenue. When the scale goes up, the more you sell, the more you earn.

As a fast-selling goods company, it has no large accounts receivable, abundant cash flow, and a daily income of 100 million yuan. Nongfu Spring can be said to be "lying down and counting money". In 2023, the company’s net profit margin on sales is 28.15%, which can kill a number of outstanding global and domestic enterprises except () (53.49%) and Hermès (32.2%).

In the soft drink industry, the net profit margin of Yangyuan drinks is 23.82%, which is still close to Nongfu Spring. The rest of Dongpeng drinks 、()、()、 Master Kong are far away from Nongfu Spring; Nongfu Spring even exceeds Coca-Cola’s 24.7% level. Wahaha, which was at its peak in 2013, has a net profit margin of about 10%, and can no longer compete with Nongfu Spring in 2023.

Competitiveness such as high ROE and high barriers

Cast five value base colors

Value based color 1: High ROE performance

In 2023, the return on net assets of Nongfu Spring is 45.88%, and the average value in 2019-2023 is 41.14%, while Dongpeng Beverage, which has the highest return rate among listed companies in the soft drink industry of class A share, is only 35.82%, and Nongfu Spring is second only to the food and beverage industry () with a return on net assets of 63.7%.

Such a high return on shareholder investment is mainly due to high pricing – high brand quality and premium power; high gross profit – the advantage of scale brings purchasing bargaining power; and high cost efficiency – the high net profit margin supported by the dilution fee of the advantage of scale.

Nongfu Spring has a certain degree of control over the pricing power of the core products and has built a high barrier to competition. The company has an advertising slogan: "We do not produce water, we are just nature’s porters". But in fact, the threshold for moving water in nature is quite high. Mastering high-quality water resources and being able to "move to high-quality clean water" is itself a unique business with barriers.

In the layout of natural water sources, Nongfu Spring is currently the largest and most extensive, and the 12th National Congress of the Communist Party of China has established its own unique moat for the layout of scarce water sources.

Value based color two: low cost advantage

In the cost structure of packaged drinking water, the cost of water itself accounts for a very low proportion. The two largest costs are raw materials and packaging materials, and the second is logistics transportation and storage expenses.

According to the prospectus of Nongfu Spring, in 2019, for example, raw materials and packaging materials, such as bottles, PET, sugar and juice, cartons, packaging, etc., accounted for about 74.9% of the total cost, and logistics and transportation costs were about 10.5%. The total of the two has exceeded 85%.

The Nongfu Spring water source area has covered most of the regions in Northeast, North, Northwest, South, Central, East and Southwest China. Using the advantage of "direct sales from the origin" around the water source area to maximize the control of logistics costs, thus forming a total cost advantage.

The company’s gross profit margin will increase from 57.4% to 59.5% in 2023, mainly due to the decrease in the procurement cost of cartons, labels and some raw materials. The retail price of a 550ml bottle of purified water is 1.5 yuan, which can achieve a gross profit margin of nearly 60%, which is directly related to its extreme supply chain and low cost.

Value-based color three: industrial layout with all types of beverages

As of the end of 2023, Nongfu Spring has 17 major brands, covering drinking water, tea beverages, functional drinks, fruit juices, and coffee, among other beverages. This has basically completed the track layout from drinking water to multiple categories of beverages, expanding the market space and reducing the competitive risk of relying on a single category.

In 2023, the company’s beverage business, including tea beverages, functional beverages, and fruit juice beverages, will account for 49.5% of total revenue, surpassing drinking water for the first time, and the product line layout has achieved remarkable results.

Coca-Cola is also expanding from the carbonated beverage market to the full range of beverages, and has grown into a multinational company with a market value of about 270 billion US dollars today. The business layout of Nongfu Spring has formed a very important moat.

(Image source: Nongfu Spring official website)

Value based color four: new brand cultivation endless

Nongfu Spring focuses on Product Research & Development and Innovation, and constantly introduces new products. On June 2, the official Weibo of Nongfu Orchard said that 100% tomato juice was upgraded and returned on the 20th anniversary of its listing, and at the same time, 100% carrot mixed fruit and vegetable juice was added.

Not only that, the company’s cultivated tea beverages have also achieved breakthrough growth beyond expectations. The company’s ten-year-old sugar-free tea drink Oriental Leaves has jumped from "the worst drink" to the company’s second growth curve, with revenue accounting for 6.90 billion yuan in 2022 to 12.66 billion yuan in 2023, an increase of 84%.

Analysts said that "after Zong Qinghou left, Wahaha needs an oriental leaf". It can also be seen from the side that the oriental leaf has provoked a beam inside Nongfu Spring.

In addition, the company’s functional beverages and juice drinks both achieved more than 20% growth. Due to the increase in consumer acceptance of the concept of screaming electrolyte water, the launch of new flavors of vitamin water, and the promotion of vitamin functionality, as well as the NFC concept in juice drinks, which meets consumers’ needs for freshness and health, the product line has entered a period of rapid expansion.

Value-based color five: deep distribution and coverage of channels

According to the information disclosed in the company’s prospectus, as of 2019, Nongfu Spring covered more than 2.37 million end point retail outlets across the country through 4,280 dealers, of which about 1.87 million end point retail outlets are located in third-tier and lower-tier cities. By 2022, Nongfu Spring has more than 4,500 dealers, covering 2.37 million end point outlets. International beverage giant Coca-Cola currently has about 4 million end point retail outlets in China.

So many end point outlets build high channel barriers. A flat channel provider system, a huge sales team, and high profits for middlemen through high-end retail pricing are all advantages of Nongfu Spring’s channel breadth and depth. Comprehensive deep coverage of the channel ensures that consumers can buy Nongfu Spring "anytime, anywhere", which is also a high barrier to entry.

Super hematopoietic ability

Since its listing in 2020, the company has achieved a cumulative net profit of 33 billion yuan, a cash dividend of 23.10 billion yuan, and a dividend rate of 70%. In terms of years, the company plans to pay 8.40 billion yuan in 2023, with a dividend rate of 69.55%. The dividend rate in 2022 is as high as 91.11%.

The high proportion of dividends is a manifestation of the company’s profitability and abundant cash reserves. Since 2017, the company’s net operating cash flow has exceeded net profit, and the cash content ratio of net profit is greater than 1.

secondary market overview

In September 2020, after the company was listed on the Hong Kong Stock Exchange, its market value rose to 750 billion yuan. Then it fell back to the range of 450 billion yuan to 500 billion yuan. As the company’s net profit rose year by year, the company’s dynamic price-to-earnings ratio also fell, and the latest price-to-earnings ratio was 33 times.

According to the net profit of 12.079 billion yuan in 2023, considering the company’s leading position in the industry, Huatai Securities gives a valuation of 38 times, corresponding to a total market value of about 459 billion yuan. The company’s current total market value exceeds 440 billion yuan, which is in a reasonable range.

Risk warning

The major risk of Nongfu Spring comes from a crisis of trust. In 2011, Nongfu Spring’s power emperor vitamin water was accused by Coca-Cola of packaging infringement; in 2020, Nongfu Spring was caught in the public opinion storm of "deforestation for water" and was sued by public welfare organizations in court; and in 2021, the word "from Fukushima Prefecture, Japan" appeared in the promotional copy of Dawn White Peach Flavor Soda Sparkling Water. In March this year, Zong Qinghou, the founder of Wahaha, passed away, and self-media killed Zhong Shansui. These all had a negative impact on Nongfu Spring’s brand perception, causing a sharp drop in stock price and a shrinking market value.