At the fork in the road, where is "Wei Xiaoli" going?

Wei Xiaoli three financial comparison, ideal performance is the best, Xiaopeng is obviously behind, NIO serious losses.

Wenshu Zhijia.com, Huang Huadan

On March 17, XPeng Motors’ earnings report finally arrived late.

Since the second half of last year, Xiaopeng has been making frequent moves, accompanied by the joining of Wang Fengying, and now it is the change of founder Xia Heng almost in name only. Since the listing of G9, it can be said that XPeng Motors has been in the most turbulent period of time. And from the data released by the financial report, XPeng Motors’ 2022 is indeed not optimistic.

As the three leading new forces that started at the same time, Wei Xiaoli has come to this day. After completing the breakthrough from 0 to 1, the personalities of the three companies have gradually become clear. Now, standing at the crossroads of development, where will Wei Xiaoli go?

Previously, when Ideal and NIO announced their financial results, we had written a detailed explanation (see also ").

After Xiaopeng releases its financial report, let’s take a look at the comparison of the three companies’ data.

The red data in the graph is the best performance, and the green data is the worst performance. As can be seen from the visual data color, relatively speaking,At present, Ideal is the brightest performer of the threeIn terms of annual delivery volume, vehicle gross profit margin, loss and other data, the ideal ranks first among the three companies

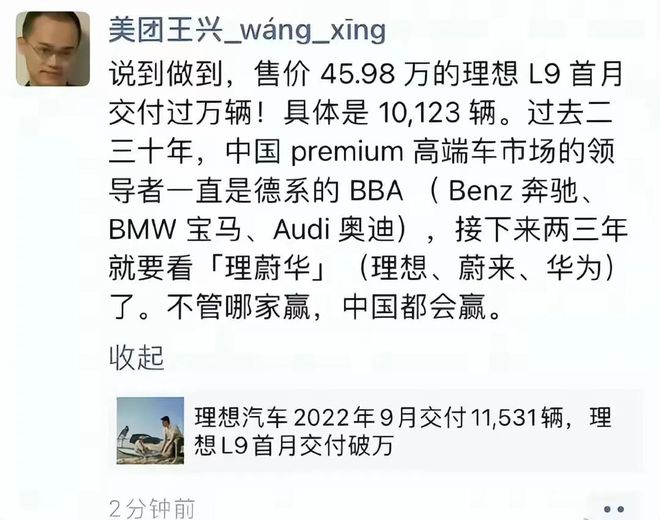

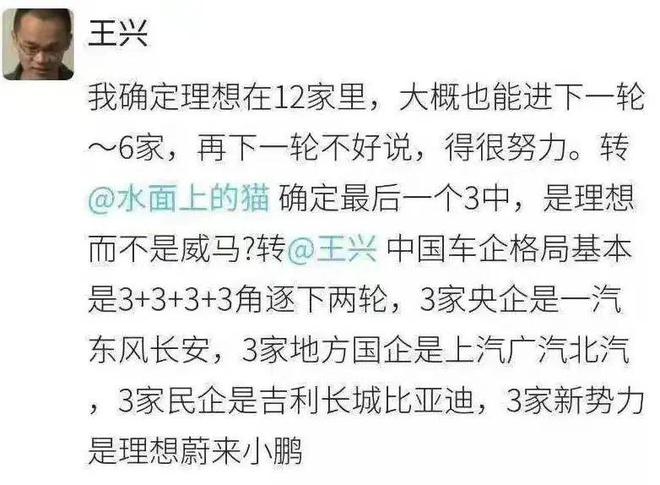

Meituan Wang Xing once regarded Wei Xiaoli as a representative of the new forces competing for the next two rounds of Chinese car companies, but his most optimistic is undoubtedly the ideal. And from the financial data, the ideal has indeed distanced itself from NIO and Xiaopeng.

01.

revenue and profit

From the perspective of total annual revenue, NIO is in a leading position with annual revenue of 49.267 billion yuan, and the ideal 45.287 billion yuan is smaller than NIO, but the year-on-year increase is the largest, compared with the 2021 operating income growth of 67.7%.

In terms of profitability, although the three companiesAre still in a state of loss, but relatively speaking, the ideal loss amount is much smaller than that of NIO and Xiaopeng. From the annual comparison, although the ideal loss ratio has increased significantly, this is due to the small loss amount in the ideal 2021, which is 321 million yuan, which is the closest to profitability among new forces. This also benefits from the extreme cost control of Li Auto.

NIO’s 2022 annual loss increased by 259.4% to 14.437 billion yuan. According to the financial report, NIO’s largest loss in fiscal year 2022 wasOperating loss reached 15.6407 billion yuanThis is still a major problem for NIO as a user-based enterprise, including power exchange services, which account for huge operating costs.

For future projections, Li Bin still sees achieving break-even in 2024 as an important goal for NIO.

Relatively speaking, although Xiaopeng’s loss growth rate is the smallest, 88.07%, the loss amount of 9.14 billion yuan is still a huge gap.

From the comparison of the three companies, a major reason for Xiaopeng’s loss is itsVehicle gross profit margin is not highIn 2022, Xiaopeng will be available for the whole yearThe gross profit margin of automobiles is only 9.4%.The ideal gross margin, although lower than in 2021, still reached 19.4%.Automotive gross margin is 19.1%.NIO gross margin and automotive gross margin will be 20.1% and 18.9% respectively in 2021, plummeting to 10.4% and 18.9% in 202213.7%…

For NIO, the performance in 2022 is also not optimistic.

In addition, observing the change in gross profit margin, it can be seen that NIO’s vehicle gross profit margin in 2022 is higher than the overall gross profit margin, while whether it is NIO in 2021 or the other two companies, the overall gross profit margin is slightly higher than the vehicle gross profit margin.

That is to say, for Ideal and Xiaopeng,Businesses other than vehicle sales can provide appropriate blood transfusions for vehicles, while for NIO in 2022, vehicle sales profits still need to bear other business expenses.This also coincides with NIO’s huge operating losses.

Li Xiang has expressed the hope to control the gross profit margin atAbout 25%In 2022, the ideal gross margin will decrease to around 19%, although it has declined, it is still at a relatively healthy level.

Xiaopeng’s gross profit margin has not been high, only hovering around 10%, which is also the reason why Xiaopeng hopes to increase the price of vehicles, but the strategic failure of G9 has exposed more problems for Xiaopeng, which has also caused Xiaopeng to experience nearly half a year of turbulence. It remains to be seen what effect the subsequent structural adjustment of XPeng Motors will have.

NIO blamed the sharp drop in gross margin on the higher-than-expected price increase of lithium carbonate in 2022. Li Bin said at the 2022 annual earnings conference: "Lithium carbonate has the opportunity to drop to 200,000/ton or even lower in Q4. NIO can return to gross margin of 18% to 20% in 2023."

02.

Delivery and new model planning

existTotal annual deliveriesIdeal also ranked first with 133,246 units. Xiaopeng has the lowest 120,757 units. But overall, the sales performance of the three companies in 2022 is not much different.

In the case of little difference in sales, NIO and Ideal’s revenue is much higher than XPeng Motors, and it can also be seen that NIO and Ideal have advantages in vehicle unit price, especially NIO, Li Bin said, "In the fourth quarter of 2022, NIO’s share in the high-end pure electric vehicle market segment of more than 400,000 yuan and more than 300,000 yuan is 75.8% and 54.8%, ranking first."

Considering the beginning of 2022, the sales targets set by the three companies are ideal 200,000, NIO 150,000, and Xiaopeng 250,000.From the perspective of target completion, NIO is the highest, reaching about 81.67%, while Xiaopeng is the lowest, only 48.32%.

And from the sales target for 2023,The ideal is to protect 250,000 cars, fight for 300,000 cars, NIO is 245,000 cars, Xiaopeng began to be conservative, for 200,000 cars.

In the recent sales performance, XPeng Motors performance is indeed not satisfactory. According to official estimates, XPeng Motors 2023 Quarter 1 delivery will be between 18,000 and 19,000 vehicles, 2023 Quarter 1 total revenue will be between 4 billion yuan to 4.20 billion yuan.

In January 2023, Li Auto delivered 15,141 vehicles, NIO delivered 8,506 vehicles, and Xiaopeng delivered 5,218 vehicles. In February, the ideal delivery was 16,620 vehicles, NIO 12,157 vehicles, and Xiaopeng delivered 6,010 vehicles.

From Xiaopeng’s own first-quarter delivery expectations, deliveries in March should be between 7,000 and 8,000 vehicles.

existFollow-up model planningOn the fourth quarter of 2022, He Xiaopeng revealed the new car plan at the earnings call. Later, XiaopengG6It will be unveiled at the Shanghai Auto Show and is scheduled to be officially released and delivered in the middle of the year. The XPeng G6 is priced in the 200,000-300,000 range, and after the mass production climb, its sales will reach two to three times that of the XPeng P7. In addition, XPeng Motors will launch an all-new model in the second half of this yearPure electric 7-seat MPV…

NIO’s product plan for 2023, according to Li Bin’s confidence, "plans to launch based on NIO’s second-generation technology platformFive brand new productsHe also revealed that after the release of all NT2 products, all NIO products can be divided into three categories: ET5 + ET5 Touring + ES6, with a target monthly sales of 20,000 units; ET7, ES7, ES8, with a total target monthly sales of about 8,000-10,000 units; EC6, EC7 Monthly sales of 1000-2000 units. Can support the monthly sales target of 30,000 units.

Regarding the ideal new car plan, it is reported that the ideal will be released this yearIn September, it launched its first pure electric modelIn the conference call on February 27, Li Xiang also mentioned that the pure electric products launched by Li Auto in the future will be the same as the L series, corresponding to the price range of 200,000 – 500,000 yuan. The first model may be officially launched in 2023, and will be launched in 2023 thereafterLaunch at least two high-voltage pure electric models every yearMake a layout.

From the current public information, the three companies’ product planning routes are also in line with their current strategies. NIO is still the brand with the most new model planning, which Li Bin and Qin Lihong also explained at the media exchange meeting. NIO is the positioning of high-end brands, and the multi-product strategy is to give users more choices.

The ideal product planning keeps a streamlined pace, while Xiaopeng is trying to broaden its categories.

It is worth mentioning that three companies areR & DinputNIO’s R & D investment in 2022 increased by 136% to 10.8363 billion, the largest among the three, and the revenue accounted for 22%. Ideally, it also increased by 106.3% compared with 2021, reaching 6.78 billion yuan, and revenue accounted for 15%. Xiaopeng is relatively small in terms of investment and growth, increasing by 26.8% compared with 2021 to 5.21 billion yuan, and revenue accounted for 19.4%.

Judging from the various aspects of the financial report, XPeng Motors is indeed lagging behind in the Wei Xiaoli three.

03.

Xiaopeng’s Anxiety and Change

The frequent adjustments of Xiaopeng in terms of personnel and structure also made the outside world see a particularly anxious Xiaopeng. Although NIO and Ideal have also experienced life and death times, the financial performance of NIO in 2022 is also not ideal, but the overall route of the two companies has always been along the established track, and Xiaopeng seemed a little flustered.

XPeng Motors’ label from the beginning was to focus on autonomous driving and technology. From the product itself, Xiaopeng’s performance was not bad, but the Oolong incident on the G9 listing exposed XPeng Motors’ marketing problems. This is also the main reason why Wang Fengying joined Xiaopeng.

According to He Xiaopeng, in the fourth quarter of 2022 earnings call, XPeng Motors’ organizational structure optimization has achieved remarkable results in the first quarter. Currently,XPeng Motors reports directly to He Xiaopeng for all R & D, production and supply chain systems, while President Wang Fengying is fully responsible for product planning and sales service systems.

In addition, He Xiaopeng also talked about XPeng Motors’ next sales channel strategy. According to He Xiaopeng, there are three points in the company’s sales strategy this year that are relatively certain.

1. Firmly promote direct sales and authorization, and the proportion of authorization will increase over time.

2. Sales channel flat organization, better training and improve better service, improve the overall channel profitability and operating efficiency.

3. Sales-only channels will become more channels with 4S capabilities.

And He Xiaopeng also said: "The system of third- and fourth-tier channels, we will mainly enter through our partners, and at the same time, we will also consider more models that can be suitable for third- and fourth-tier channels to sell better in product planning."

A few days ago, it was reported that XPeng Motors has completed the reform of its marketing system.

In terms of internal organizational management structure,Auto Trade and UDS two channel teams complete mergerPreviously, the two channels of XPeng Motors belonged to different responsible persons, and there was a problem of system internal friction. The direct sales model belongs to the entity of XPeng Motors Trading Company, and co-founder He Tao is in charge. Authorized dealers are managed by UDS (user relationship development service center), and are headed by Liao Qinghong, chief talent officer and vice president of sales of XPeng Motors.

And in the sales system, thenRemoved the sales regions of the two major channels across the country and re-divided them into more than 20 sales communities across the countryThe directly-operated stores and authorized dealers in each community are in charge of the person in charge of the community.

At a time when the direct sales model is increasingly becoming the main sales method of new forces, XPeng Motors’ decision to turn around and re-invest in 4S stores will inevitably cause controversy. However, from He Xiaopeng’s statement, Xiaopeng hopes to capture more lower-tier markets through 4S stores, so as to further expand sales. And this strategy did help Xiaopeng quickly expand the number of stores in the early days.

On the other hand, Xiaopeng is also seeking cost control. According to He Xiaopeng, XPeng Motors will achieve a cost reduction of more than 50% for autonomous driving from this year to next year, and a cost reduction of about 25% for the entire vehicle hardware (including the power system).

After selecting a plan, will the follow-up XPeng Motors be able to return to its original position? And will NIO and Ideal be able to rise to the next level in the cutthroat competition in 2023? In a sense, Wei Xiaoli’s three companies are still representatives of new domestic forces, and their performance reflects the development of the industry to a certain extent.

[Follow smart cars, follow WeChat Channels]

Cooperation or news leads are provided, contact email: editor@autor.com.cn