Meituan has been losing money, why is the value 300 billion?

As of May 24th, the market value of Meituan Dianping (03690.HK) has reached 350 billion Hong Kong dollars, about 307.60 billion yuan, has surpassed Baidu, JD.com and even Xiaomi, becoming the third largest Internet Tech Giants after Ali and Tencent, turning the BAT club into ATM.

In contrast, in the United States listed Ctrip, the latest reported $36.46/share, the total market value of 19.50 billion dollars, about 133.90 billion yuan, the difference between the two is more than half.

On May 23, Meituan Dianping announced its first quarterly report of the new year after the close. The financial report showed that Meituan Quarter 1 revenue was 19.17 billion yuan, an increase of 70.1% from 11.30 billion yuan in the same period last year. The operating loss was 1.303 billion yuan, and the adjusted net loss was 1.04 billion yuan.

This is the internet company’s 17th quarterly loss since 2015, but Meituan’s loss is nearly 35% compared to the 3.734 billion loss in the previous quarter.

The specific reason is that although one of Meituan’s core businesses – food and beverage delivery – has experienced a comprehensive decline in the three indicators of total revenue, transaction value and transaction number, the company’s other core monetization business – to the store and wine hotel business is still very bright.

According to the financial report, Meituan’s store and wine travel business achieved revenue of 4.49 billion yuan in the quarter, an increase of 43.2% year-on-year; the gross profit was 4 billion yuan, and the gross profit margin reached 88.3%, which can be said to be comparable to Moutai.

Figure: Meituan comments on the first quarter of 2019 financial report

Among them, Meituan’s wine travel business has been compared with Ctrip and is regarded as one of Ctrip’s strong competitors.

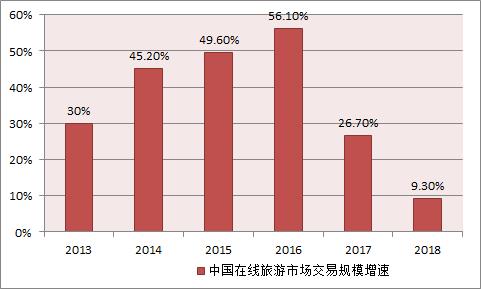

Analysys Intelligence released an annual comprehensive analysis of China’s online travel market in April. The year-on-year growth rate of China’s tourism revenue in 2018, as well as the scale of online travel transactions, are at the lowest level in the past five years. China’s online travel industry has entered a stage of medium-to-high-speed development.

Among them, the transaction scale of China’s online travel market in 2018 was 975.424 billion yuan, with a year-on-year growth rate of 9.3%. Compared with the past five years, the growth rate slowed down and was below double digits for the first time. Looking back at historical data, the transaction scale growth rate of China’s online travel market from 2013 to 2017 was 30.0%, 45.2%, 49.6%, 56.1% and 20.7% respectively.

The slowdown in the growth rate of the industry has caused headaches for the giants in the online travel industry such as Ctrip, and what is even more troublesome for them is the fierce competition in the industry. The position of the giants is not stable.

At present, China’s online travel market is mainly dominated by Ctrip and Qunar, with Flying Pig Travel ranking third. The combined market share of the three companies is close to 70%, and the market concentration is relatively high. Among them, Ctrip and Qunar belong to the first echelon in the industry, while Flying Pig, Mafengwo, Meituan and other companies belong to the second echelon.

For a long time in the past, traditional OTAs (online travel agencies) such as Ctrip have controlled the flow and entrance of online wine travel through the air ticket business, obtaining excess orders and revenue. However, this situation is gradually changing due to the addition of emerging forces such as Meituan and Feizhu.

Among them, Meituan Dianping has seen the rise of various businesses of the company since it went public in 2018, including the store and wine travel business.

According to the annual report, the total transaction value of Ctrip in 2018 was 725 billion yuan (excluding the previously acquired Skyscanner), an increase of 30% year-on-year, and it firmly ranked as the largest OTA in China.

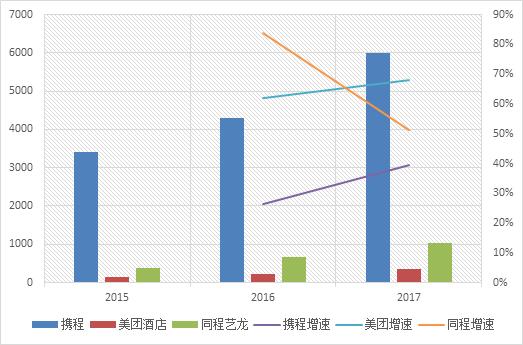

Meituan’s store, hotel and tourism business in 2018 was 176.80 billion yuan, Ctrip is more than 6 times, but still slightly higher than the same journey eLong. In 2018, the same journey eLong’s annual total transaction volume was 131.50 billion yuan, an increase of 28.5%.

Transaction volume is the basis for platform revenue generation, and OTAs usually recognize transaction commissions and merchant advertising fees as operating income, which requires a large transaction volume.

In terms of revenue, Ctrip’s revenue is much higher than that of Meituan’s wine travel part. In 2018, Ctrip achieved revenue 30.965 billion, which was 10 times that of Meituan’s store and wine travel sector (15.84 billion yuan) in the same period. Meituan’s historical data shows that from 2015 to 2018, the company’s store, hotel and tourism business revenue was 3.77 billion yuan, 7.02 billion yuan, 10.85 billion yuan, and 15.84 billion yuan, respectively. Four times.

From the perspective of growth rate, Ctrip’s revenue growth rate in 2018 was 15.7%, much lower than the 46% growth rate of Meituan Wine Travel.

In addition, we divide revenue by transaction volume to determine the OTA’s liquidity. For the full year of 2018, Ctrip’s overall liquidity rate was 4.3%, Tongcheng Eilong’s overall liquidity rate on a consolidated basis was 4.6%, and Meituan Dianping’s in-store and hotel business was 11.1%, the highest among the three companies.

In addition, GMV (total transaction value of booking business), Ctrip is still the boss. According to the prospectus submitted by Meituan Review before its listing last year, the GMV of Meituan Hotel in 2017 was 36.50 billion yuan, and the GMV of Ctrip during the same period was 600 billion yuan, which is 16 times that of Meituan Hotel.

However, from the perspective of growth rate, Meituan’s growth rate is still much higher than that of Ctrip. In 2017, Ctrip maintained a 40% GMV growth rate, largely relying on the merger of the British search platform Skyscanner. In 2018, its GMV growth rate fell to 20.8%.

Figure: GMV comparison of Ctrip, Meituan Hotel and Tongcheng Eilong

On the other hand, the number of room nights in Meituan’s hotel business is also surpassing that of Ctrip. In the hotel tourism business, the profit growth mainly comes from the increase in the number of room nights booked by hotels.

Meituan disclosed in the 2018 annual report that the number of domestic hotel room nights increased from 205 million in 2017 to 284 million in 2018, an increase of 38.5% year-on-year, and the average price per night increased steadily.

But it is worth noting that Meituan’s domestic hotel industry grew 38.5% year-on-year to 284 million in 2018, lower than last year’s growth rate of 55.5%. The number of hotel room nights in the first quarter of this year was 78.60 million, an increase of 29.8% year-on-year, and the growth rate slowed slightly.

According to Trustdata’s third-party monitoring data, Meituan Hotel’s market share in domestic hotel bookings has reached 46.2%, ranking first in the industry, and surpassing the sum of Ctrip, Qunar, and Tongcheng Yilong in March 2018.

But the number of nights seems to have become a bottleneck for Ctrip, and now it has even stopped disclosing the year-on-year growth rate of nights. According to industry estimates, the number of nights at Meituan Hotel has exceeded that of Ctrip as early as 2016.

In addition, although Ctrip still maintains a large advantage in the high-end customer group and high-star hotel resources; Meituan Hotel continues to release signals of penetration from the low-end market to the high-end market. At present, Meituan has more than 250,000 hotels in tier 3-5 cities, accounting for 85%, capturing the user market that Ctrip has not fully covered.

Ctrip’s share is gradually being eroded.

The reason why Meituan has been able to catch up with Ctrip in the wine travel business so quickly is that its huge traffic advantage is a key factor.

Although Ctrip’s annual transaction volume is much higher than that of Meituan Hotel, in terms of the number of annual transaction users, Ctrip has been overtaken by Meituan Reviews.

According to Sun Jie, CEO of Ctrip, two brands, Ctrip and Qunar, have 130 million annual transaction users in China, according to a 2018 conference call. In comparison, Meituan Dianping’s total annual transaction users in 2018 were 400 million.

Although Meituan has another major business that accounts for a major share, Meituan management has said that 90% of the users who booked hotels through Meituan in 2018 were existing takeout users or in-store consumers.

In short, Meituan uses the high-frequency business of takeaway to raise a traffic pool of trading users for 400 million years, and traffic monetization extends its value chain through low-frequency, high-customer unit-price businesses, such as tourism and hotel businesses.

And as mentioned earlier, the first quarter gross profit margin of the wine hotel business was as high as 88.3%, which can be said to be a well-deserved profit center.

In contrast, Ctrip has suffered a lot in terms of traffic due to the lack of online traffic entry.

Overall, Ctrip still has a large advantage in terms of volume, but as a rising star, Meituan has successfully achieved the status of one of the "giants" in the hotel field by virtue of the platform effect, the ecological closure of comprehensive life services and its own service level, and is encroaching on Ctrip’s market at an extremely fast speed.

But then again, in the OTA industry, established companies such as Ctrip have spent nearly 20 years cultivating, and various new players such as Airbnb have entered the market from all aspects, which are also competitive forces that cannot be ignored. Standing at the crossroads of the transformation of the online wine travel industry, Meituan, who is only 8 years old, still has a long way to go.

If you like this article, you can see more stocks, disk trend analysis and investment skills moer.cn Moore Financial APP or Moore Financial official website, or search for Moore Financial on Sina Weibo, WeChat official account, Jinri Toutiao and follow.